Figuring out gas mileage cost

Lowest full tank was 103 mpg highest was 189. Average used car prices topped 20000 in late 2018 according to Edmunds while the average new car transaction price was.

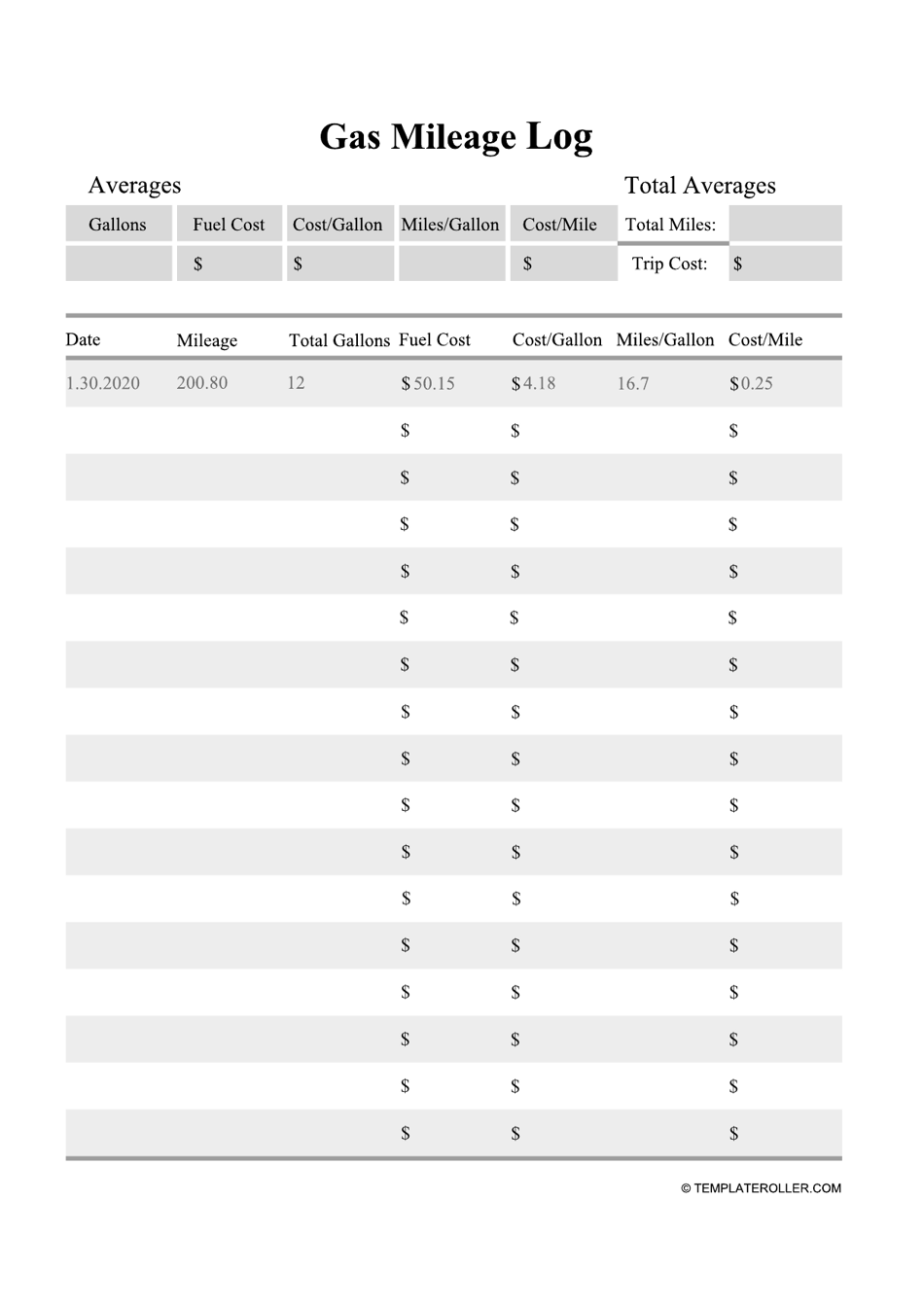

Gas Mileage Log And Mileage Calculator For Excel

Make sure to include the cost of mileage tracking if any as a tax-deductible business expense.

. 32-gal100 miles Mini Electric. The city is only just now in the process of taking it over from the state. Now youll need to compute the cost of driving your own car.

Apply for a Gas Station Credit Card. The superior gas mileage provides an edge and the hybrids range is 676 miles versus the gas Camrys 544 miles. 42 Renumbered and updated Exhibit 4411-26 Analysis of SPE Factual Scenarios of Probable Reserves.

We welcome your comments about this publication and suggestions for future editions. What is a mileage deduction. For claims made on or after January 8 2018 alternative fuel mixture means a mixture of taxable fuel and alternative fuel other than liquefied petroleum gas LPG compressed natural gas CNG liquefied natural gas LNG liquefied gas derived from biomass and.

The portion of the vehicles cost taken into account in figuring your section 179 deduction is limited to 26200. We provide assignment help in over 80 subjects. Smaller trucks cost a lower standard rate and lower mileage fee.

Can You Write Off Gas for DoorDash. To determine the cost of charging an electric car you simply multiply the cost of electricity in your area by the vehicles fuel efficiency. I did hit an EVIC which reads within 1 to 4 of hand calculated most of the time rated 222 mpg for a 500 KLM stretch on part of one tank but the rest of the way was into a huge headwind and dropped the overall average for the full.

The exemption amount begins to be phased-out at amounts over 85650 and is completely phased-out at 188450. The income from the sale of products of any farm mine oil or gas well. 40 Replaced IRM 44119 Definition of Terms Pertaining to the Oil and Gas Industry with Exhibit 4411-44 Glossary of Oil and Gas Industry Terms.

You can contact us any time of day and night with any questions. This is where the mile factor comes into play. Unless the estate or trust is an independent producer or royalty owner claiming percentage depletion for oil and gas wells.

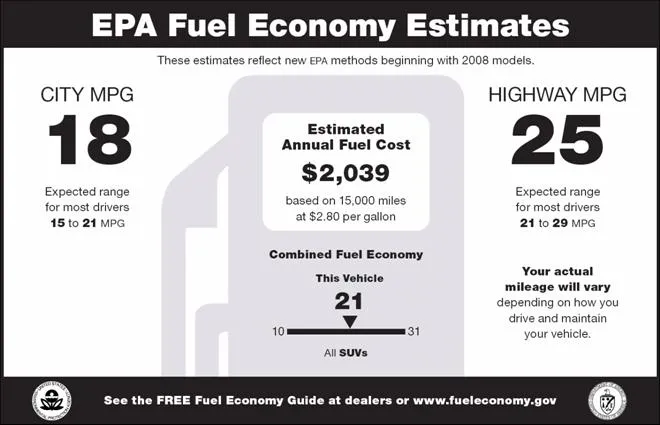

The cost of buying property including principal payments on a mortgage. Gas station credit cards may offer even more generous rewards for fuel and related purchases. The EPAs fueleconomygov gas mileage information page shows that the Corolla hatchback consumes 29 gallons of gasoline per 100 miles.

However you must reduce your basis by any deductible casualty loss deduction for clean-fuel vehicle gas. You make the election to use the safe harbor for each taxable year in which qualifying amounts are incurred. The election is made by attaching a statement to your income tax return for the taxable year.

10000 for questions about how to calculate the unadjusted basis refer to Figuring the Unadjusted Basis of Your Property in Publication 946. Theyre what youll want to rent if youre moving out of a three-bedroom house or larger or if you live in a two-bedroom house with a lot of possessions. Depreciation limits on cars trucks and vans.

As you can see below the Mini Hardtop gets better gas mileage than the Kona but the Kona Electric is more efficient than the Mini Electric. Making the cost of auto loans and leasing more expensive. Car expenses and use of the standard mileage rate are explained in chapter 4.

We will take care of all your assignment needs. Look at the mess that is 82nd ave. We are a leading online assignment help service provider.

Expect a volume of space around 1000 to 1600 cubic feet and a maximum weight load of around 5000 to 7000 pounds. NW IR-6526 Washington DC 20224. 1091 The best writer.

One of the first steps you should take when you are considering buying or leasing a new or used vehicle is figuring out how much you should spend on the car. You can use the standard mileage rate for a vehicle you own or lease. Figuring Out the Cost.

The cost of domestic labor maids gardeners etc. At the current average price of unleaded. This term essentially relates to mileage reimbursement the money you are legally entitled to scratch off from your total mileage.

However if youre moving from a house compared to an apartment wed recommend the bigger yes the more expensive truck. In figuring the days of presence in the United States you can exclude only the days on which you actually competed in a sports event. The Honda Accord Hybrid and Chevrolet Malibu Hybrid also beat their base gas versions by 299 and 124 miles respectively.

41 Added IRM 44119 Activities and Services Provided on the US. The big truck can make one trip the small truck will have to make multiple trips and will rack up mileage. Recently posted this on an other thread.

Be sure to add in gas costs rental insurance and any extra fees too. Gas taxes do not cover nearly the full costs of roads. The calculator employs three powerful algorithms the Revised Harris-Benedict the Mifflin-St Jeor and the Katch-McArdle equations to calculate your TDEE and BMR.

Thats a perfect example of a gas-tax-funded road that the City of Portland had little say over for decades And in case you missed it Oregon instituted a bicycle tax five. Instead of figuring actual expenses you may be able to use the standard mileage rate to figure the deductible costs of operating your car van pickup or panel truck for business purposes. For more information see chapter 11.

For instance in the first 90 days after opening your card the BP Visa Credit Card delivers 25 cents off per gallon for every 100 in BP gas station purchases 15 cents off for 100 in eligible grocery dining and travel purchases. For tax year 2021 the standard mileage rate for the cost of operating your car van pickup or panel truck for each mile of business use is 56 cents per mile. If you value maximum seat time before refueling a hybrid has what you need.

Hence the reason we add these extra features to our homework help service at no extra cost. This includes knowing your total trip mileage figuring out the average gas price in the areas youll be driving through and also including your own vehicles fuel efficiency. Generally 3- 5- 7- or 10-year property under the modified accelerated cost recovery system MACRS.

For 2021 the standard mileage rate for the cost of operating your car for business use is 56 cents 056 per mile. Well always be happy to help you out. Our Total Daily Energy Expenditure TDEE and Basal Metabolic Rate BMR calculator is the perfect tool to help you achieve your workout objectives.

The 2021 rate for business use of your vehicle is 56 cents 056 a mile. As of July 1 2022 the IRS has raised the medical mileage rate from 18 cents to 22 cents for the remainder of the year citing high gas prices. My all in hand calculated average is 154 mpg.

April 11 2022 at 1117 pm. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Now there are three main categories of mileage deductions.

Would opt for per mile cost if this is a part-time thing and you have bigger problems to dedicate your brain energy to figuring out.

Mileage Reimbursement Calculator

Gas Mileage Log And Mileage Calculator For Excel

How To Estimate The Cost Of Gas For A Road Trip Easy Calculations

![]()

Gas Mileage Log And Mileage Calculator For Excel

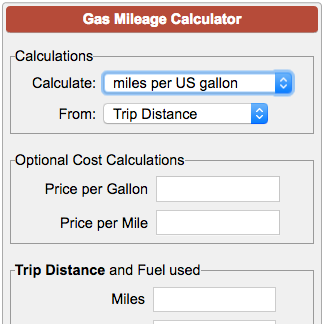

Gas Mileage Calculator

Excel Formula Odometer Gas Mileage Log Exceljet

Gas Mileage Log Template Download Printable Pdf Templateroller

Mileage Calculator Credit Karma

Gas Mileage Log And Mileage Calculator For Excel

Time To Stop Measuring Fuel Economy In Mpg Science Smithsonian Magazine

What Is The Most Fuel Efficient Cargo Van Fleet Gps Telematics Tracking

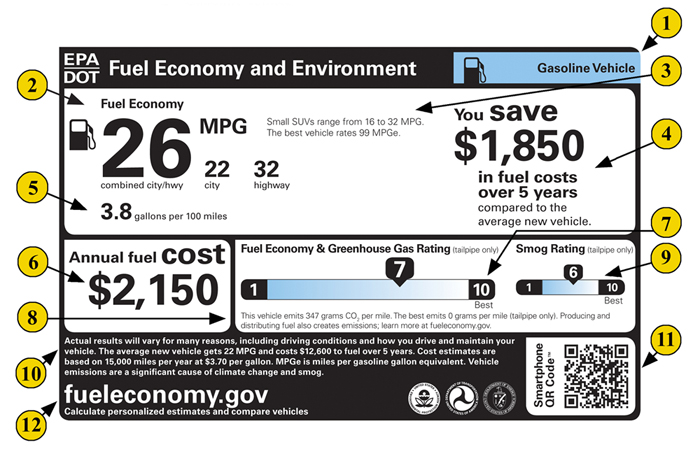

Text Version Of The Gasoline Label Us Epa

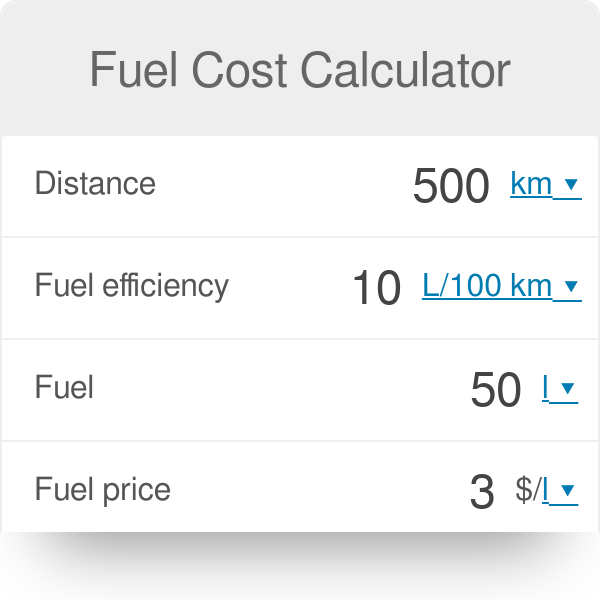

Fuel Cost Calculator

The Mpg Illusion Website Calculate Your Gas Use Costs

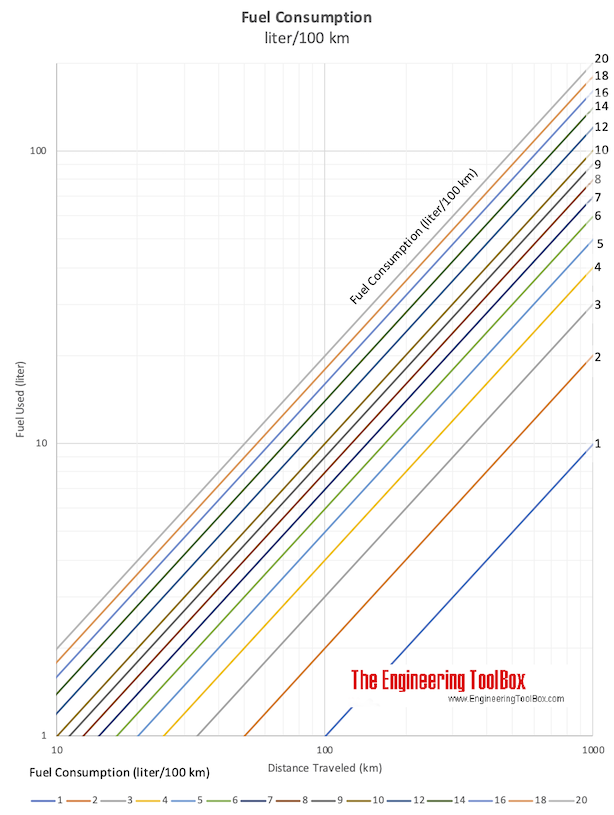

Car Fuel Consumption Liter 100 Km

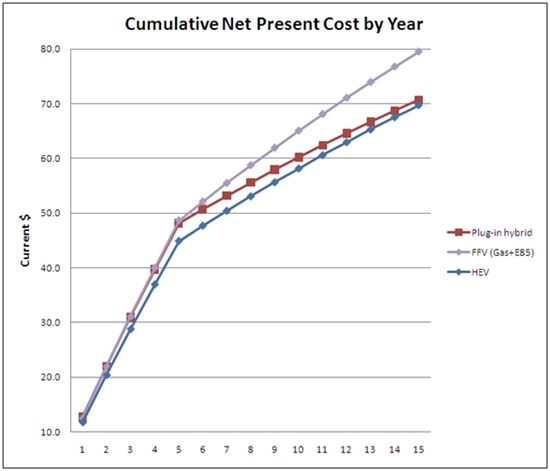

Alternative Fuels Data Center Vehicle Cost Calculator Assumptions And Methodology

Gas Mileage Log And Calculator Gas Mileage Mileage Log Printable Mileage Chart